The federal government will stop production of major economic data if the government’s funding ends on Wednesday, depriving policy makers and investors of important information amidst deep concerns about the job market.

If President Trump and Democratic MPs failed Reach a funding deal Before Wednesday’s deadline, Labor Statistics Bureau (BLS) will stop until it is closed A casual scheme Was released on Monday by the Labor Department.

This will prevent BLS from releasing the much awaited September job reports as a schedule on Friday, and can delay the agency’s collection Other major economic figuresBLS also produces the consumer price index (CPI) data on inflation and wages – both are closely viewed by policy makers and investors.

“Many economic data cannot be released during shutdowns,” Kaili Cox wrote the main market strategist of Ritholtz Wealth Management, One Monday analysis,

“This is a big thing for our interest-by-superhero (Federal Reserve), who preach about how they prefer to decide on economic figures. You, me and Fed Chair Jai Powell are all blind flying without these important reports.”

Investors and policy makers are already struggling to create an understanding of the American economy after several major shaking. Major BLS data lack for experts can make even more difficult to assess where the economy is going to a significant turn.

Inflation and unemployment usually move in opposite directions, as prices rise when consumers have more purchasing power and fall when companies are struggling to find the demand for their products.

But ever since Trump took over, the President’s tariff has pushed prices more, while large -scale exile and serious deduction in federal workforce gives drought to the labor market.

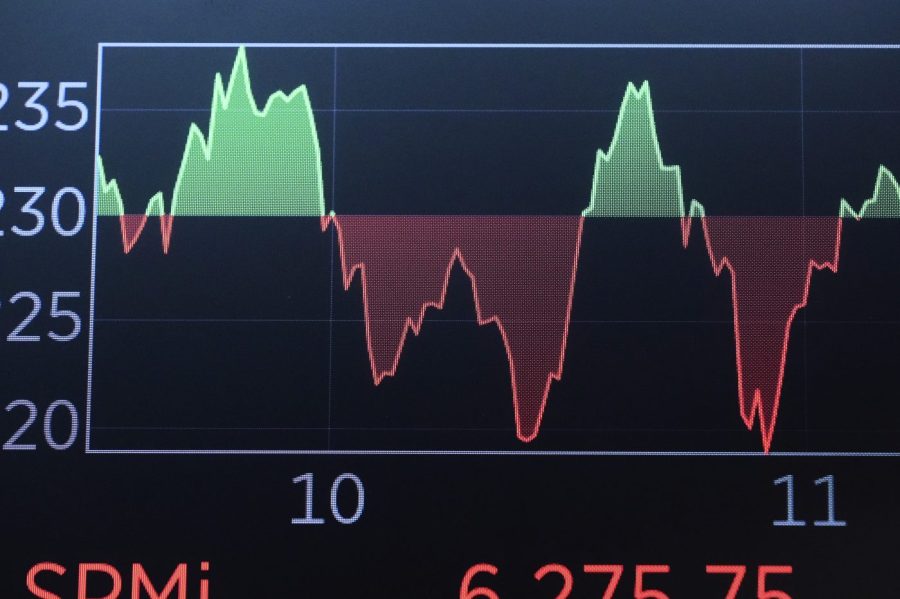

After the annual inflation rate fell to 2.4 percent in March in August, it was measured by CPI, reaching 2.9 percent. The unemployment rate also increased to 4.3 percent in August in August, and the US has added only 29,000 jobs per month this year.

Fed Interest rate cuts Earlier this month, when the authorities expressed increasing alarm on the weak job market, even inflation continues to accelerate.

Powell said in a press conference after the cut that while the economy still faces inflation risks from Trump’s tariff, the “unusual” fall in the job market had become a major concern for the fed.

“There is a very low growth, if any, in the supply of workers. And at the same time, the demand of the workers has also come down very fast, at the point where we see that I have said a curious balance,” Powell said.

“Usually, when we say things are in balance, it sounds good. But in this case, the balance is that both supply and demand have reduced quite rapidly. Now, the demand is coming a bit faster, because now we see the unemployment rate rising,” he continued.

A brief government shutdown may have a limited impact on the federal government’s economic data collection, and the Fed must have enough time to read another on the labor market before its next interest rate meeting in November.

Previous funding laps have also had a limited impact on the overall economy, even when they consider serious financial burdens, they can place on federal employees, contractors and their dependents.

“Shutdown alone has not done enough to avoid a prosperous economy. They have never led to a recession or market accident, even if anything has happenedduringRecession or market accidents. Typically, Shutdown has led some early shakeness in the stock market, even if the disadvantage is only temporary, “Cox wrote.

But threatened to set fire to the White House – not only furls – thousands of government employees during a shutdown are a major economic risk for this shutdown fight.

“There will be another blow to absorb a shutdown, and it is difficult to say how well the investors will absorb it. I would feel better about the shock absorption part if the economy was in a better place, and this catalyst was a little more defined,” he wrote.