A container is offloaded from the Wanhai 175 cargo ship at the Tan Vu Terminal, operated by Vietnam Maritime Corp., at Haiphong Port in Haiphong, Vietnam, on Wednesday, Jan. 15, 2025.

Bloomberg | Bloomberg | Getty Images

The proportion of volume from suppliers in China, Hong Kong, and Korea has declined from 90% to 50% over the past decade, reflecting a long-term diversification of supply chains that picked up steam during the first Trump administration and trade war, according to an analysis from Wells Fargo Supply Chain Finance.

“From 2018 to 2020, the supplier diversification away from China nearly doubled after the first tariff actions,” said Jeremy Jansen, head of global originations at Wells Fargo Supply Chain Finance.

He said since the first trade war, the gradual increase in supply chain diversification away from China to the South Asia Pacific region has steadily grown.

“Based on our supplier counts, diversification is now 50/50 between the northern Asia Pacific region and the Southern,” Jansen said. “The migration of midsize suppliers can be tracked into Taiwan, Vietnam, Indonesia, Thailand, India, and Malaysia,” he added.

Imports from China to the U.S. have dropped by 26 percent year-over-year, according to data from freight intelligence firm SONAR, but trade volumes from China to the South Asia Pacific region have significantly increased.

According to Project 44, which tracks supply chain shifts, China’s trade in 2025 has increased to Indonesia by 29.2 percent, Vietnam by 23 percent, India by 19.4 percent and Thailand by 4.3 percent. In turn, year-over-year container trade volume to the U.S. is up 23 percent for Vietnam, 9.3 percent for Thailand, and 5.4 percent for Indonesia.

While it remains unclear what will happen to President Donald Trump‘s tariffs plan with the U.S. Supreme Court decision pending and major companies already suing for refunds, in the short-term, the impact of Trump’s tariffs can be seen increasingly on business balance sheets, as U.S. importers are turning more to financial arrangements in an effort to preserve cash.

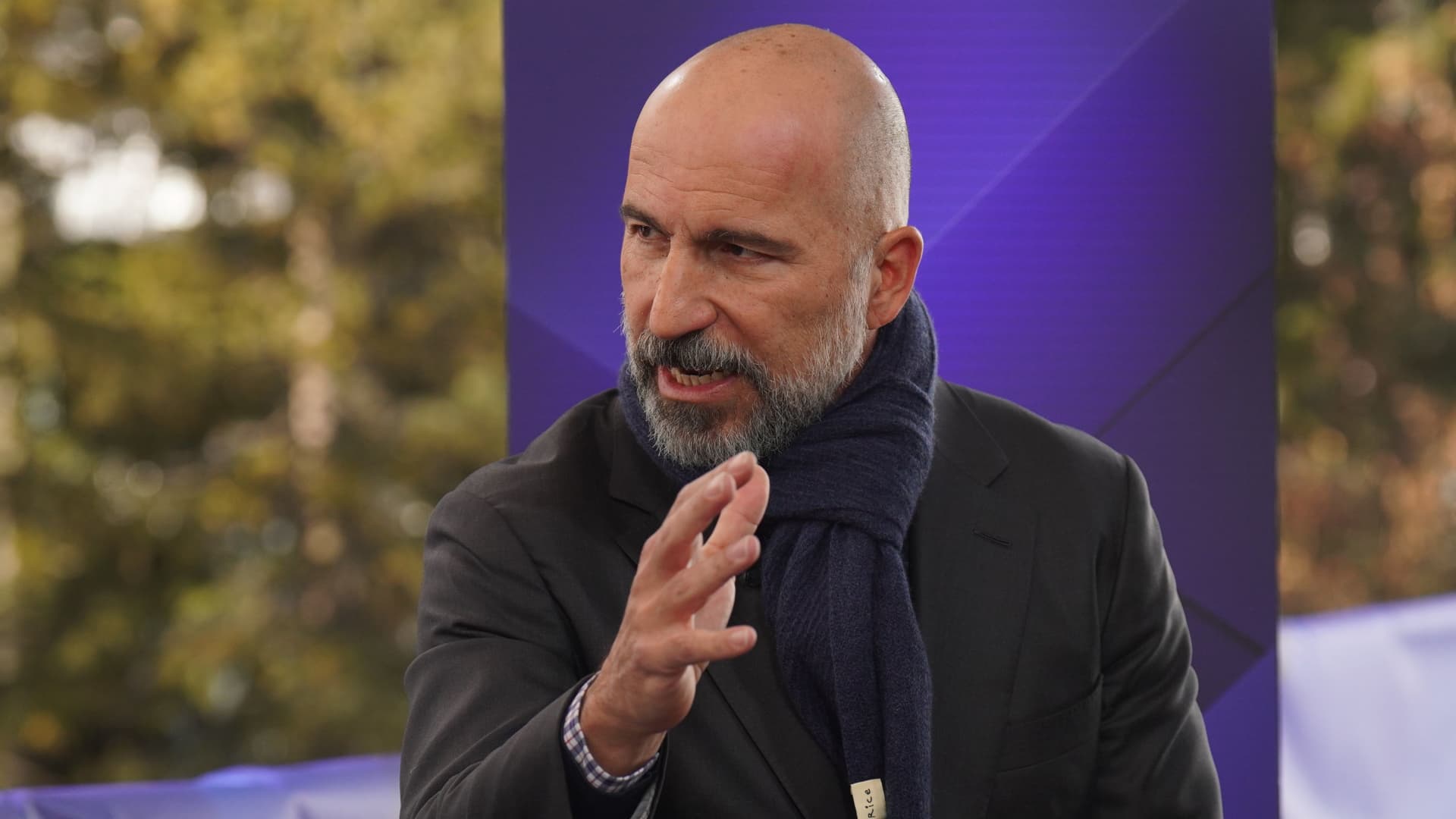

“We have seen an increase in working capital needs post-Liberation Day due to higher tariffs,” said Ajit Menon, head of HSBC’s U.S. trade finance business. “The average tariff increased from 1.5 percent to double digits,” he said.

Menon said the financial hit varies industry to industry. For example, generic pharmaceuticals and retail/apparel lack negotiating power due to thin margins. “This is why trading counterparties are negotiating payment terms as an alternative, which is where the need for financing emerges,” said Menon.

HSBC, which finances more than $850 billion in global trade flows annually, introduced its Trade Pay platform earlier this year, which helps clients monetize receivables, payables, and inventory.

Since Trump’s initial April rollout of sweeping global tariffs, Menon says the bank has seen a roughly 20 percent increase in financing flows across all client segments, and use is increasing as the inventory brought into the U.S. in early 2025 as part of a trade frontloading winds down. “The surplus inventory brought in to offset tariffs is now nearly exhausted,” Menon said. “That means companies will need more working capital moving forward as terms get renegotiated.”

In a recent survey of 1,000 U.S. companies conducted by HSBC, more than 70 percent of respondents said they were facing increasing working capital requirements year over year, and Menon said this is prompting many to reexamine their supply chain strategy and their payment terms.

“They are looking into what rates they are paying, and also the financing duration. Cash is becoming king,” he said.