After imposing unilateral tariffs on dozens of American trading partners in April, the financial markets are shaking this week after extending their 90-day deadline for large trade deals over the weekend.

As the markets are reacting to changing the policies of the White House, policies are responding to the markets, and investors are not seeing any ends of feedback loops in the near period.

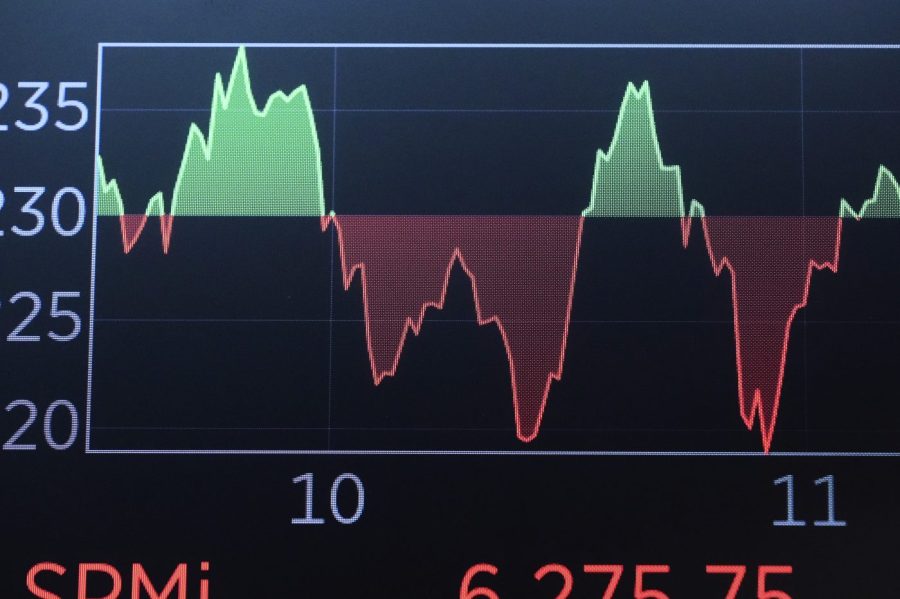

The Major Stock Index continued its Danteedar dynasty in the morning trading on Tuesday after tambling on Monday.

Dow Jones Industrial Average fell more than 100 points in the morning trading on Tuesday after taking a dip of about 400 points on Monday. S&P 500 was flat in the afternoon after a decline of 0.7 percent between Thursday and Monday.

Secretaries of Commerce and Treasury Departments pushed the time limit of trade deals till 1 August in the weekend before the Wednesday’s deadline declared in April.

But Trump has reduced the water of this week on the limit of that time this week, saying that it is “100 percent firm”, then on Tuesday, saying that “no change will happen” in the date.

“Markets are craving certainty,” Stephen Moro, managing partner of Beacon Policy Advisors, told The Hill.

Trump sent letters to countries on Monday, which threatened both higher and low tariffs than the original “mutual” tariffs declared in early April.

The rates threatened for Japan and Malaysia were high, but the rates for Kazakhstan, Laos, Myanmar, Tunisia, Bosnia and Herjegovina, Bangladesh, Serbia and Cambodia were low.

The rates for South Korea, South Africa, Indonesia and Thailand were the same.

Since almost all tariff letters either maintain or reduce potential rates, investors are looking at letters as a straight extension of the deadline for deals, which are proven to be difficult to impress in the beginning compared to the approximate White House.

Westwood Capital Managing Partner Dan Elpt gave it a policy of “Protnd and Extension”.

“Tariff Story [will keep going like this] As long as they find out how to continue to show and expand, which they are now, “they told the hill.” They are showing that these tariffs are becoming effective, but they never look effective. ,

Although the “mutual” tariffs of the White House are once again, several tariffs are applicable, including 10 percent of normal tariffs, tariffs on steel and aluminum and 25 percent on automobiles.

Fitch ratings held the overall effective US tariff level at 14.1 percent at the end of June.

While the import tax, both were promised and implemented, are acting as interaction and policy equipment, investors say that auto tariffs are a real glued points – especially for American business relations with South Korea and Japan, which export a large number of cars to the US.

South Korea and Japan are aggressively demanding exemption from auto tariffs and are not retreating from their position. Japanese exports saw an annual decline of 1.7 percent in May, the first decline in eight months.

“Car tariffs are quite important on Japan,” said alpart. “They have a huge beef.”

There is also concern with American businesses about Malaysian exports of semiconductors and electronics devices – industries that have been the subject of large American law in recent years.

“Especially with semiconductor and consumer electronics, is a meaningful business relationship with Malaysia,” Law firm Sidle Austin told The Hill, leader of a business unit atori Ted Murphy.

Trump also said that on Tuesday he would implement 50 percent import tax on all imported copper, which Commerce Secretary Howard Lutnik said that will be effective by August.

“Copper will be 50 percent, and this idea is to bring copper home, bring home production home. Bring the ability to make copper, which is important for the industrial sector, back home to the US.

Markets are responding to trade policy development this week, but policies have also changed in response to markets during Trump’s trade war.

The original 90-day stagnation in the “mutual” tariff that was extended over the weekend came after seeing a spike in April of the Bond market that provoked economists at the White House.

The National Economic Council chief Kevin Haset said, “There is no doubt that the Treasury Market made it yesterday so that it was time for the time – it was probably a little more urgency.” After stop,

Scott Linsicom of the Cato Institute on Monday commented on the ongoing trade talks for market conditions on Trump’s personal sensitivity.

He wrote in a commentary, “The President is deeply concerned about the market response to the American tariff landscape (ie, full and immediate mutual tariffs and significant vengeance).

While the White House has shown that its drive to implement the tariff is forced by the performance of the financial market-an idea by the Taco Trade Thesis, in which “Trump always removes chickens”-taking some policies more seriously.

“We think the approach to President Trump’s tariff has evolved from his first term to his second term,” Murphy said. “In the first term, tariffs were really to run talks. … Now, they believe that tariffs are good in themselves.”

Myro expressed a similar view.

“With the arrival of Taco Trade Thesis, it pretends to investors to blow uncertainty until otherwise proves, which they start,” he said. “They are assuming a lot of risk. … Uncertainty is not a bug, this is a feature of this administration.”

The White House has so far announced deals with the United Kingdom, China and Vietnam, although there are top-line agreements without any fine print.

The US industry’s reaction to the UK deal was mixed, the aerospace sector gave it a thumb-up and the auto sector gives it a thumb-down.