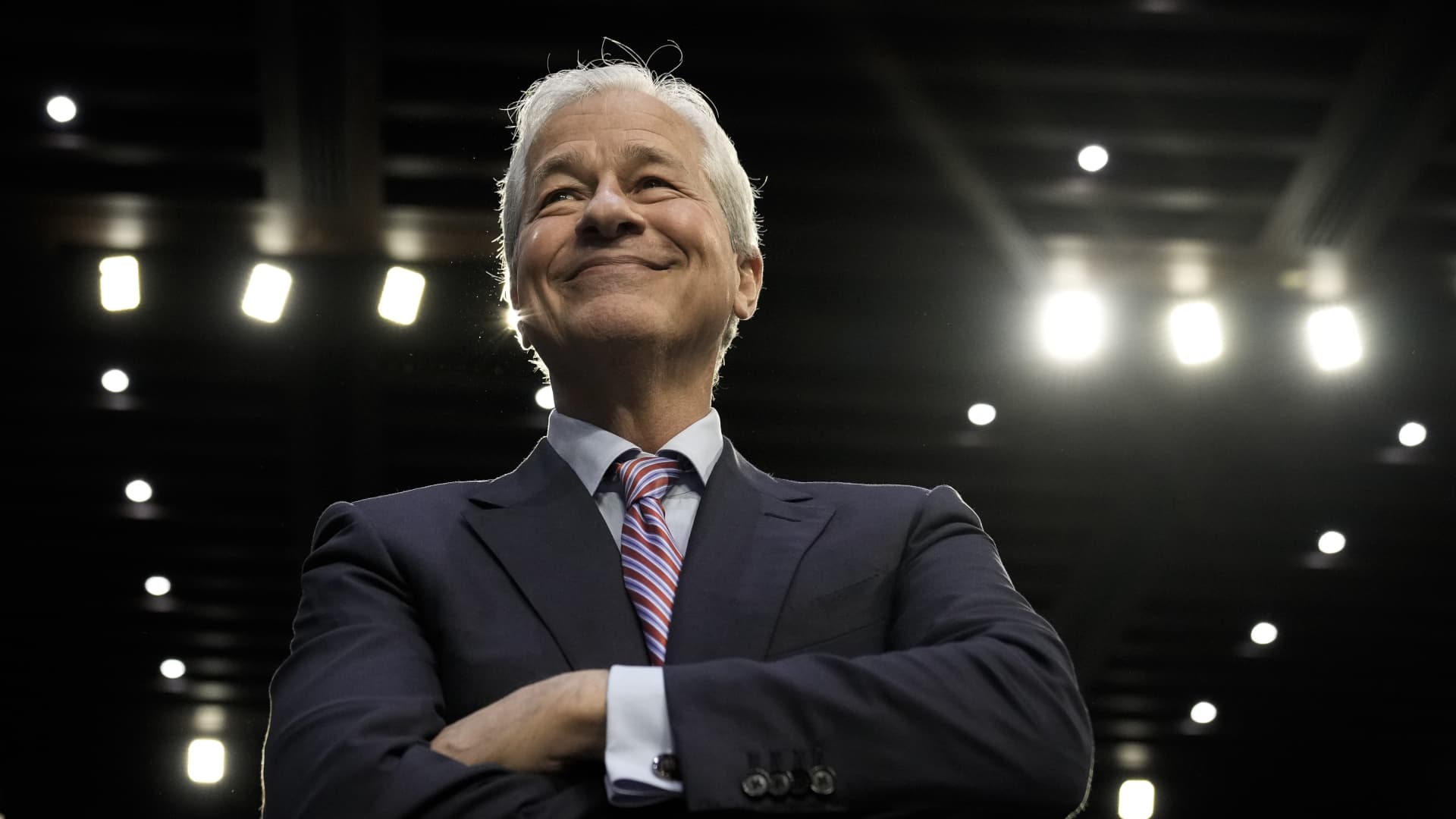

JPMorgan Chase & Co CEO Jamie Dimon arrives for a Senate Banking, Housing, and Urban Affairs Committee hearing on Capitol Hill September 22, 2022 in Washington, DC.

Drew Angerer | Getty Images

JPMorgan Chase on Tuesday topped analysts’ estimates for the third quarter as trading and investment banking generated about $700 million more revenue than expected.

Here’s what the company reported:

- Earnings per share: $5.07 vs. expected $4.84, according to LSEG

- Revenue: $47.12 billion vs. expected $45.4 billion, according to LSEG

The bank said in a release that profit jumped 12% to $14.39 billion, or $5.07 per share, from a year earlier. Revenue rose 9% to $47.12 billion.

So far this year, the biggest American banks have benefitted under the administration of President Donald Trump.

They’ve reaped higher trading revenue as upheaval from his policies has roiled markets around the world, forcing investors to reposition themselves. JPMorgan’s trading haul of $8.9 billion was a record for a third quarter, CEO Jamie Dimon said in the release.

Investment bankers are busier thanks to a more relaxed stance toward mergers, and Trump’s bank regulators have proposed ways to ease capital requirements and stress tests. Stock market indices that are at or near record levels have helped the wealth management divisions of banks including JPMorgan.

Fixed income trading at JPMorgan jumped 21% in the quarter to $5.6 billion, about $300 million more than the StreetAccount estimate.

Equity trading surged 33% to $3.3 billion, also roughly $300 million more than expected.

Investment banking fees jumped 16% to $2.6 billion, edging out the $2.5 billion StreetAccount estimate.

Dimon said that while each of his major business lines performed well against a good economic backdrop, he was preparing the firm for possible turbulence ahead.

“While there have been some signs of a softening, particularly in job growth, the U.S. economy generally remained resilient,” Dimon said.

“However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation,” Dimon said. “As always, we hope for the best, but these complex forces reinforce why we prepare the firm for a wide range of scenarios.”

JPMorgan’s provision for credit losses rose 9% to $3.4 billion, exceeding the $3.08 billion estimate, indicating that the firm is preparing for higher loan defaults down the road.

Big banks have outperformed regional lenders so far this year; the KBW Bank Index has climbed nearly 15%, while the KBW Regional Banking Index has dropped roughly 1%.

Goldman Sachs, Citigroup and Wells Fargo also report earnings Tuesday, with Bank of America and Morgan Stanley releasing results Wednesday.

This story is developing. Please check back for updates.