President Trump is racing to respond to a major escalation of the US-China trade war as US supplies of critical technology hang in the balance.

Trump administration officials this week announced plans to take a more active role in ensuring access to “rare earths” — minerals that are key components in many critical technologies — in response to new Chinese export restrictions.

The new rules give China a significant advantage in its trade war with the US as the two countries race to dominate the future of AI and semiconductor chips needed to power the technology.

The US and China have been at odds for decades over tech exports and defense-related technologies, and Beijing could relax new rules or issue waivers to bring the temperature back down.

But experts say China’s latest actions reflect an unprecedented willingness and ability to test the limits of its relationship with the US at a dangerous time for mobility between the two countries.

“We’re just playing with fire here,” said Edward Alden, a senior fellow at the Center for Foreign Relations.

“We really don’t know what the potential consequences will be. We may be able to limit it to fairly small fires, or it could really get out of control with extraordinary consequences that are hard to predict.”

Months of progress toward a U.S.-China trade deal stalled last week when the Chinese government announced new, sweeping restrictions on rare earth minerals and related products.

The sanctions require companies to seek licenses for products manufactured overseas that contain small amounts of certain rare earth minerals from China or that rely on Chinese rare earth mining technologies.

It also announced new export controls on five additional rare earth minerals as well as various rare earth and lithium battery-related technologies.

The move threatens to devastate many high-tech industries that depend on the materials.

These materials are essential for semiconductors, electric vehicles and US F-35 fighter planes. China plays a big role in this sector, accounting for about 70 percent of the world’s rare earth mining by 2024, according to Oxford Economics.

Owen Tedford, a senior research analyst at Beacon Policy Advisors, suggested that the Chinese government sees this as an advantage it can use to pressure Washington into rolling back the sanctions.

“The Chinese see this as a very powerful source of leverage, largely because the supply chain outside China is not well developed, so the US doesn’t have easy options to go and increase their purchases,” Tedford said.

Beijing had earlier tried to extend its dominance over rare earths by imposing export bans on seven minerals in April, after the US imposed huge new tariffs against China and dozens of other countries.

While the minerals themselves can be found widely in small quantities, it is difficult to find deposits large enough to be economically viable for mining.

Lewis Lu, head of Asia economics at Oxford Economics, warned in a research note on Tuesday that even partial disruption to supply chains would “resonate across markets.” He said such sanctions could reduce US growth by at least 1 percent over two years.

However, Lu said this is a “lower bound estimate” that “significantly underestimates the market impact of rising bilateral growth.”

China’s move on rare earths drew a sharp reaction from Trump, who threatened 100 percent tariffs and new export controls on “critical software.” Renewed tensions between the two superpowers, which earlier appeared to be moving closer to a trade deal, rattled the markets.

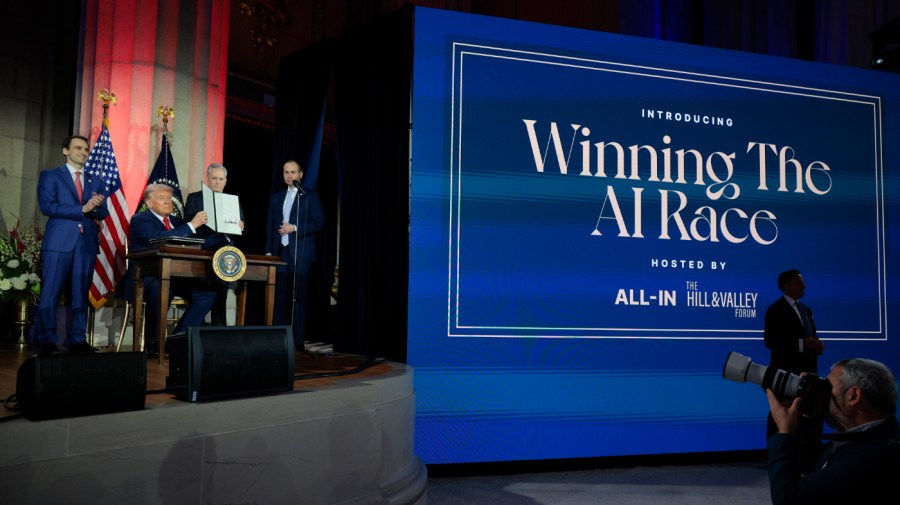

The US and China have already taken major steps to undermine each other’s AI and chip manufacturing capabilities. In recent years, Washington has rapidly expanded export controls on semiconductors.

The Trump administration initially banned Nvidia’s H20 chips before reversing the ban this summer, which faced a bipartisan backlash. According to the Financial Times, Beijing has taken steps to prevent Chinese companies from buying Nvidia chips.

While Trump struck a softer tone after the announcement — telling his Truth Social followers, “Don’t worry about China, it’ll be all right” — the latest sanctions have sparked a new push to expand U.S. access to rare earth minerals.

“When we get an announcement like this week with China on rare earths, you realize we have to be self-reliant, or we have to get by with our allies,” Treasury Secretary Scott Besant told CNBC on Wednesday.

“When you are facing a non-market economy like China, you have to adopt an industrial policy,” he said.

The Trump administration has already been changing US industrial policy by taking stakes in public companies in recent months – a policy Besant indicated will continue.

Trump approved a merger between U.S. Steel and Japan’s Nippon Steel in June after the companies signed a deal giving the government “golden shares.” In July, the Defense Department took a nearly 15 percent stake in rare earth miner MP Materials.

The administration also took a 10 percent stake in struggling US chipmaker Intel in August and recently announced stakes in Canada-based mining companies Lithium Americas and Trilogy Metals.

Besant also said on Wednesday that the government plans to set price levels in several industries and will need to create “strategic mineral reserves”.

“What you are seeing is a more domestic and even, to use a Biden-era term, friend-shoring of these supply chains and an effort to develop alternatives to China,” Tedford said.

However, he cautioned that building such a supply chain could take time and that China is in a “unique position” given its geography, boasting large rare earth reserves.

According to the U.S. Geological Survey, China has nearly half of the world’s total reserves, about 44 million metric tons. In contrast, the US has 1.9 million metric tons, or about 2 percent.

Alden said that while the Trump administration could help pump more money into U.S. mining efforts, the U.S. has “no coherent strategy for achieving self-sufficiency in rare earth materials.”

“I think these steps are an acknowledgment of how far behind we are as a country in implementing the kind of strategy that you should have started 10 or 15 years ago,” Alden said, calling the White House’s recent actions “very haphazard.”

Trump’s own instability may also play a role in how strictly China enforces the new rules and how willing Beijing is to risk U.S. retaliation.

“I would be somewhat surprised if the sanctions did not go into effect. But I think what you might see happening is that China provides assurances that the licenses will be approved for sale,” Tedford said. “So basically business as usual, but for China it becomes a very easy on-off switch that they can use in case they want to increase pressure.”

Contributed by Rachel Frazin,