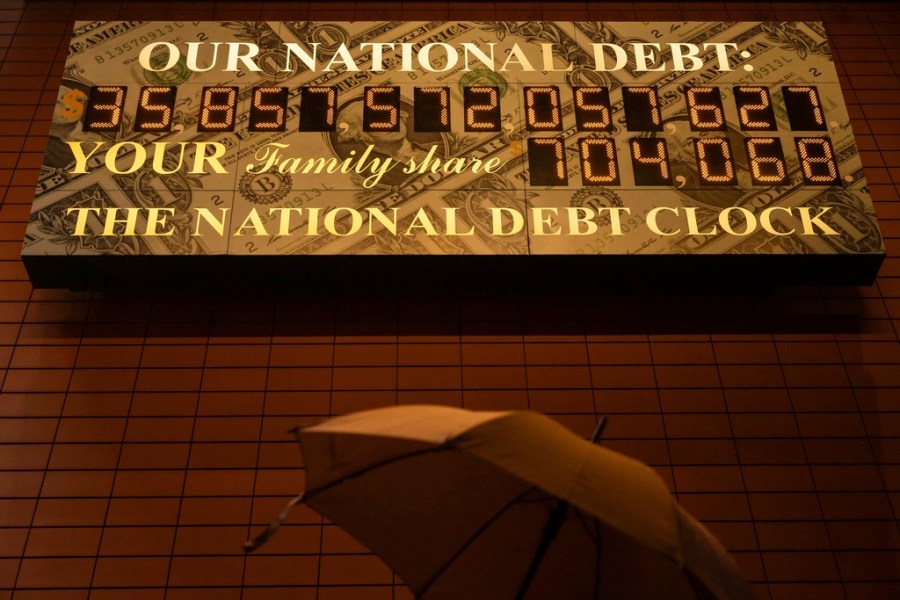

Moody’s recently US credit rating downgrade Once again the national loan is put into the spotlight. Treasury bond yields and President Trump’s recent increase in the passage of the “large beautiful bill”, which is likely to increase the debt, has added concerns about the country’s fiscal state of the country. Budget Director of former President Barack Obama, Peter Orszag joined Chorus, warns in one new York Times Essay that is now the time to worry about the loan.

There are three main concerns about government loans: fear of default, fear that more debt will lead to high interest rates that endanger private investment, and in the end, it is concerned that our deficit is continuously continued by the grace of foreign countries, such as China.

All these concerns are full of misguided understanding about the role of the government in the monetary system.

The discourse around the national loan prefers the government from a private sector unit that can be forced by default by its creditors. But the US government is not like a family or business – it cannot default on the represented loan in the dollar, as it is going to release the dollar.

Although our government may opt for not paying its bills – for example, refusing to increase artificially imposed debt roof – it can never technically get out of money to pay bondholders. Former Federal Reserve Board Chairman Alan GreenSspan Correctly recognized, “The United States can pay any loan because we can always print money to do so. So there is zero possibility of default.”

Families and businesses need to earn income or sell property to pay their loans. But for the government, payment of your loan is only to exchange one liability for another. A exchange between John Stewart and former Canasus City fed Chairman Thomas Honig Shows the point well. Answering a question about why we can’t just print the money to the foreigners to pay their loans, Hanig said, “Everything you are doing is changing a loan for the other, because money is printed is a responsibility, the Federal Reserve System is a loan of the system. The dollar, the liability that Fed is made, is now owed to China.”

In fact, the US dollar has been recorded as liabilities on the balance sheet of the Fed – it is not controversial. When the US government pays back to its bondholders, it only constructs this liability on the balance sheet of the Fed.

Another concern about government loans stems from the belief that the government has borrowed tap in a limited source of personal savings, increasing the interest rates. Bond yields recently get reliability for this belief to swings. In fact, when the government spends, it adds to national income and hence to save private sector. Government shortage is the same, dollars for dollars, net saving of non-government sector, including American business and homesThis is simple accounting. Thus, the lack of government creates adequate savings to buy government issues.

Even more important, interest rates on treasury bonds are not really market-based; They closely track the policy rate determined by the Fed. Although it is true that the premium (to some extent) on the long-term bonds is market-determined, even it can be controlled tightly by the fed, if this happens, the Fed has done with quantitative ease policies.

Thus, the US government is currently spending more on interest payments as the markets are punishing it, but because the Fed has raised the interest rates. In addition, recent swings of interest rates have been done in tens of basis digits. Fed can reduce interest rates less than 400 basis points tomorrow. If the fed was to reduce its goal and was promised to keep it there, the long-term treasury bond rates would decline in hundreds of basis points-if not much or not to cut government spending on interest in half.

Finally, the US government’s ability to run the common deficit is common that China’s desire to lend us. If China stops buying a US Treasury Bond, it will not endanger the US government’s ability to finance itself. The US government is self-funded-that is, it makes the money that it spends.

If China does not want an American Treasury Bond, the result may demand a high premium for a bond of certain maturity. But there is a buyer of the last resort in the US Treasury Market – Federal Reserve – One of the main responsibilities of which is to maintain “orderly market” for US Treasury Securities. Fed can take any bond that China decides if it does not want and whatever rate the fed wants to set.

Debt damage has been wrong before and will be proved wrong again. Government debt is not a very bad wolf. It is a safe property that performs an important function in financial markets and portfolio. Neither the decrease is unusual for a country like America – for good economic performance in the US, it is necessary that the government usually spend more in the economy, as it takes out through taxes; This is what allows the private sector to save and accumulate safe property, such as government bonds.

Budget deficit in future and the resulting debt ratio result will largely depend on economic performance and fed behavior. More important, large deficit does not require the performance of our economy and endanger our standard of living. This is the time when we stop worrying about deficit and debt and begin to love the economic development generated by them.

Yava is the chairman of the economics at the nursesian Franklin and Marshall College. Randel Ray is a professor of economics at Levi Economics Institute of Bard College.